Instant, Standards-Based Informal Valuations

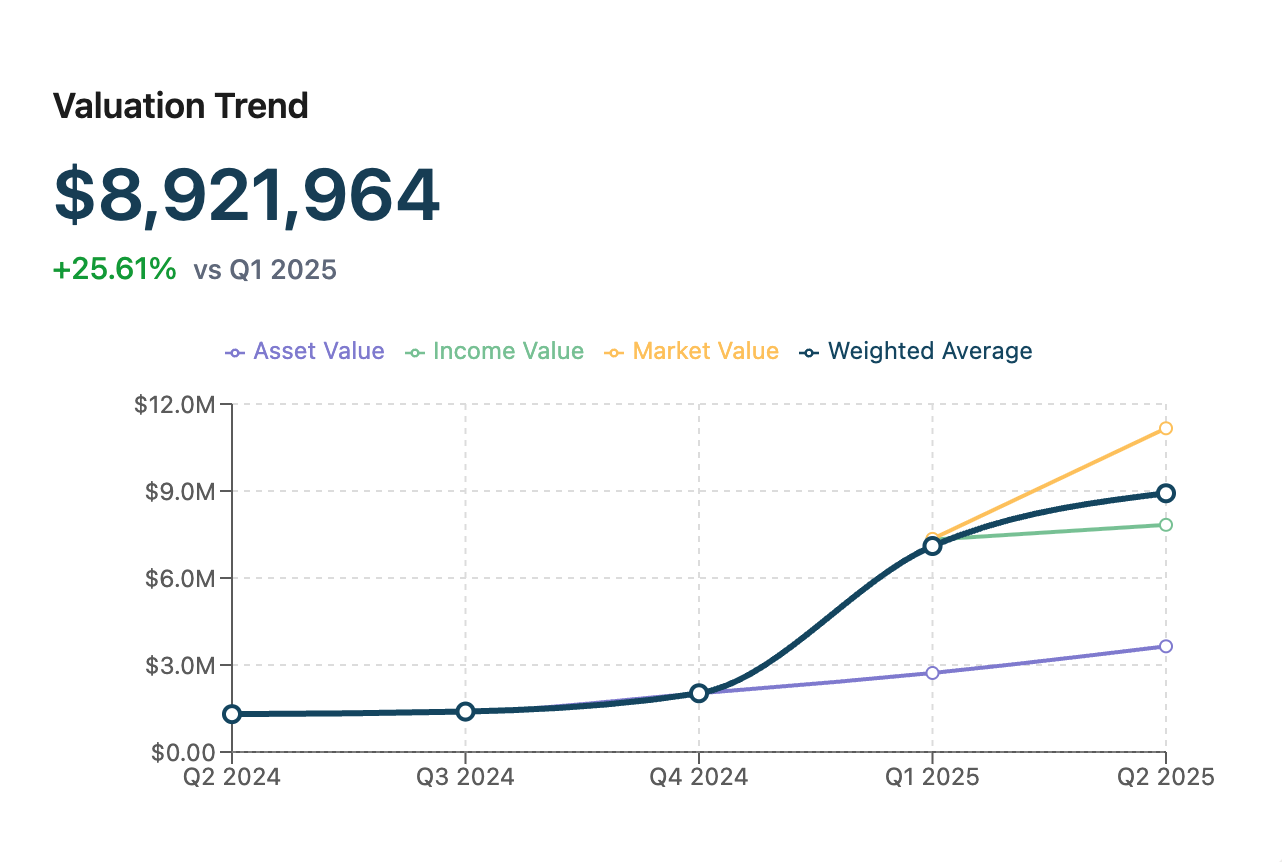

Hyperion's informal Valuation Assessments deliver instant, standards-based business valuations using the same accepted methodologies relied upon by valuation professionals.

Typically used for internal planning and ongoing operational performance optimization —Hyperion gives you fast, transparent, and defensible insight into what a business is worth in today's market environment and the key metrics driving future value creation.

Three Proven Methodologies. One Seamless Experience.

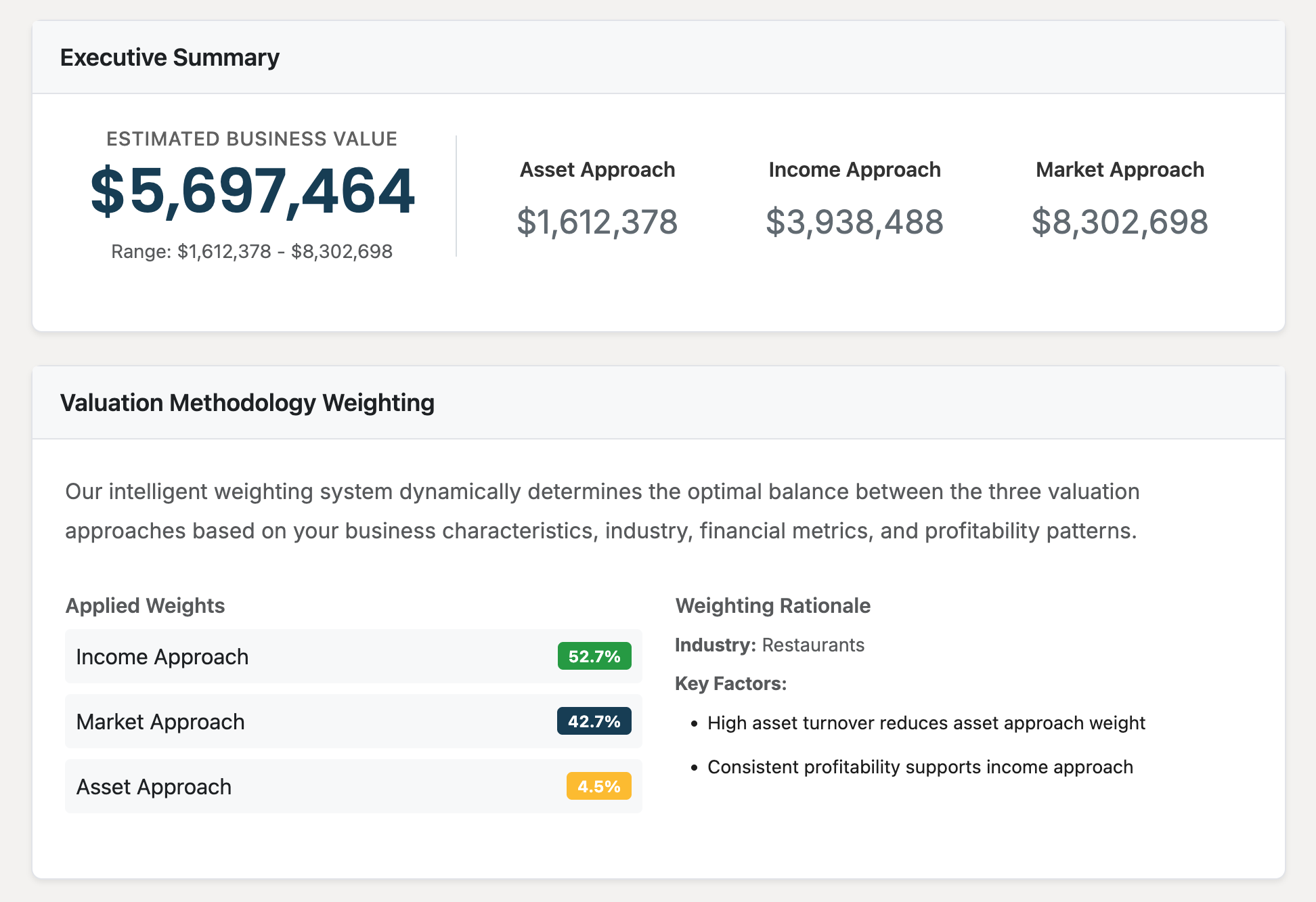

Easily calculate Fair Market Value (FMV) estimates using all three of the most widely accepted valuation approaches. These approaches follow guidelines set by key valuation standards-setting bodies in the U.S—so the results can be used with confidence across a range of planning, advisory, and compliance scenarios.

- Income Approach – Discounted Cash Flow (DCF) method, based on future earnings

- Market Approach – Comparison to similar-sized businesses using real-world comp data

- Asset Approach – Net asset value based on reported assets and liabilities

Professional-Grade Standards for Professional-Grade Outcomes.

Hyperion's valuation assessment logic, benchmarking methodologies and AI analyst insights are designed to align with the most widely accepted U.S. business valuation standards and IRS guidance. While Hyperion does not provide financial, legal or tax advice, our informal valuation outputs leverage established frameworks and financial analysis practices.

Built on Data No One Else Has.

Designed for Decisions No One Else Can Make.

Hyperion puts institutional-grade informal valuation tools in the hands of everyday decision makers—without sacrificing speed, transparency, or trust.