Clarity and Control Across Every Privately Held Entity

Family offices often manage complex ownership structures, diverse businesses, and multi-generational reporting needs. Hyperion delivers the visibility and standardization required to make informed decisions quickly—while strengthening governance across all holdings. With Hyperion, your team can:

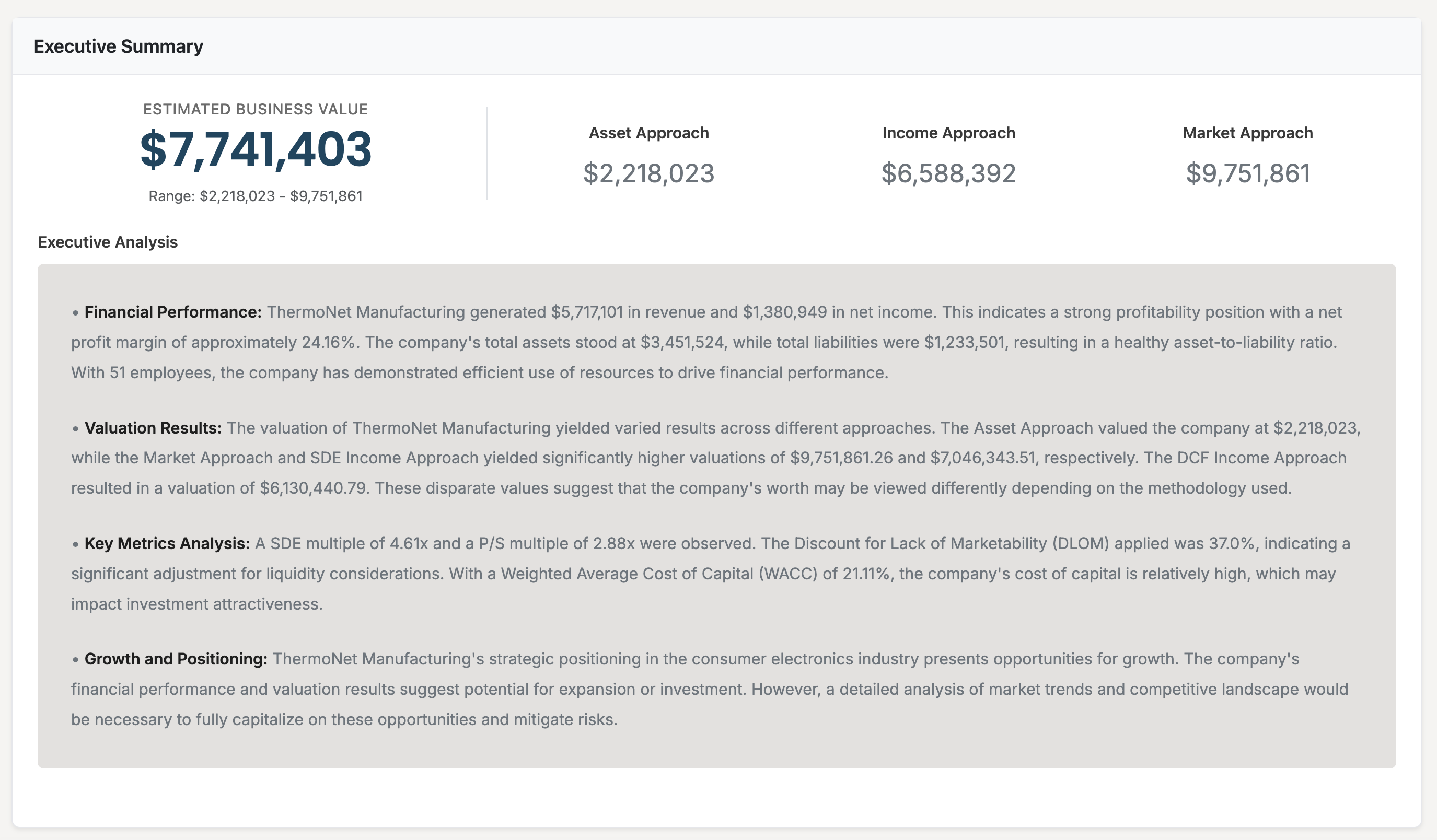

- Assess the health and value of privately held companies in real time

- Identify liquidity and risk concerns early through automated monitoring

- Compare performance across entities using consistent benchmarks

- Automate tax, audit, and compliance reporting inputs using standardized financial analysis

- Simplify reporting for principals, trustees, and advisory teams

A Unified Intelligence Layer for Multi-Entity Family Office Operations

Hyperion brings structure, transparency, and analytical rigor to private-company oversight—helping family offices operate with greater confidence and fewer manual burdens.

- Direct integrations with company-authorized accounting systems

- Automated valuations based on real operating performance

- Benchmarking powered by data from 450,000+ private-company financials

- KPI tracking tailored to long-term investment and stewardship goals

- Monitoring tools designed to surface operational red flags early

- Analysis that supports investment, planning, tax, audit, and governance workflows

Hyperion empowers family offices to evaluate holdings with a higher level of precision, ensure continuity across generations, and maintain a scalable, data-driven approach to private-company management.